Using Trends Analysis

Available exclusively to BDSwiss WebTrader users, Trends Analysis is a multi-purpose tool that automatically tracks price action in real -time. The tool also seeks out developing patterns, identifies key support and resistance levels, generates potential trading recommendations and assists with stop-loss and take-profit order placement.

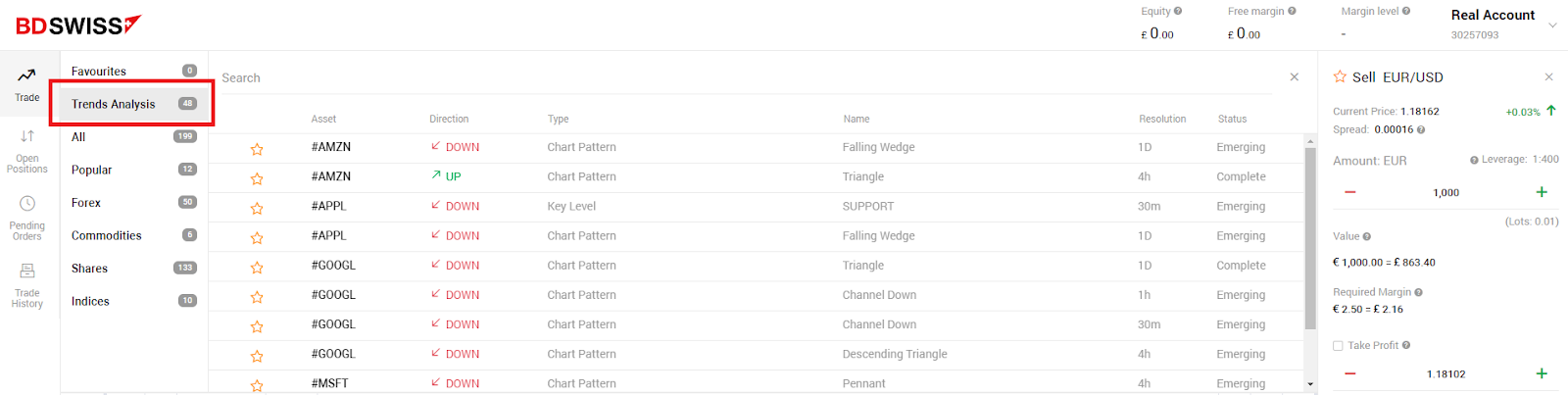

To begin using the Trends Analysis tool, navigate to the BDSwiss WebTrader application via the Dashboard. In the top left corner, click on ‘Trends Analysis’. The number adjacent to the text indicates the number of available trade setups currently available.

All available chart pattern recognition setups are shown in the main window.

Various parameters are categorised into columns such as ‘Asset’, ‘Direction’, ‘Type’, ‘Pattern name’, ‘Resolution (timeframe)’ and ‘Status’.

Asset: Available asset classes include Forex, CFDs, Stocks, Precious Metals and Commodities.

Direction: Expected direction of emerging trade setup

Type: Chart pattern, key level or Fibonacci

Name: Type of chart pattern

Resolution: Candlestick timeframe (15 minutes – 1 month)

Status: Emerging or Completed

Traders can scroll through the list of available setups and select the most option they determine most suitable.

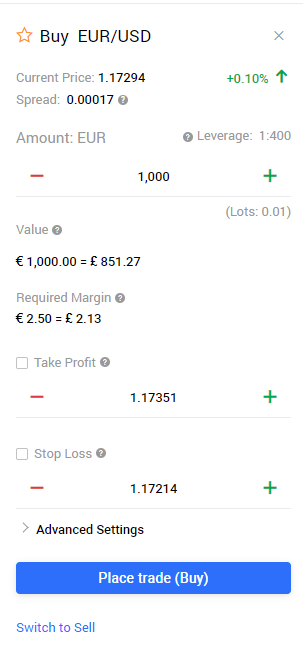

In the instance shown below, the trade setup is for a short EUR/USD position during a declining trend channel.

All potential trade ideas are suggested on the right-hand side of the screen.

Traders can select their desired trading volume by clicking on the plus or minus signs, or, entering a value manually. The trade value, as well as the required margin to open the trade will be displayed accordingly.

Traders can review the trade suggestion and choose to accept or reject the suggested Take Profit and Stop Loss levels.

Clicking the Place Trade button will execute the trade.

Start trading

The Trends Analysis search window allows traders to define the parameters by which to scan potential trade setups. It can be tailored to your individual trading style, or you can use it to search markets that are less familiar and find opportunities that you may not have otherwise considered.