Market Analysis Review

RBA Rate steady at 4.35%, USDJPY refuses to fall, U.S. Crude oil price dives, Silver is back on the list of week’s top performers, U.S. indices on an uptrend

Previous Trading Day’s Events (07.05.2024)

This followed a disappointingly high inflation reading in the first quarter and the labour market failed to cool as much as expected, with the jobless rate at 3.8% in March.

“The combination of the less hawkish than expected language in the post‑meeting statement and the larger than expected upward revisions to the RBA’s inflation forecasts over the next few quarters implies the hurdle to another hike could be higher than markets have been expecting,” said Adam Boyton, head of Australian economics at ANZ.

The Federal Reserve is now expected to cut less than twice in 2024, a change from about six reductions priced in at the beginning of the year.

______________________________________________________________________

Winners vs Losers

Silver (XAGUSD) is on top of the week’s list and month with a 3.05% weekly performance. It is followed by the JPY pairs. Two possible interventions took place last week, Monday and Thursday, causing JPY strengthening and bringing down the pairs (JPY as Quote). Since the 3rd of May, the pairs have been moving on an uptrend again.

______________________________________________________________________

______________________________________________________________________

News Reports Monitor – Previous Trading Day (07.05.2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

Yesterday, the Reserve Bank of Australia decided to leave the cash rate target unchanged at 4.35% and the interest rate paid on Exchange Settlement balances unchanged at 4.25%. Recent data indicate that inflation continues to moderate, but is declining more slowly than expected. The market reacted with AUD depreciation at the time of the release. AUDUSD dropped near 30 pips before retracing to 61% of the move and reversed to the downside quickly. An overall sharp drop reached near 44 pips before the pair reversed to the 30-period MA.

- Morning – Day Session (European and N. American Session)

No important news announcements, special scheduled releases.

General Verdict:

__________________________________________________________________

__________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (07.05.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The pair was not affected heavily by market activity but only after noon. Around that time, the U.S. dollar started to depreciate causing the EURUSD to move upwards until the resistance at near 1.07870 before it reversed to the 30-period MA and continued aggressively to the downside. After 17:00 the U.S. dollar had experienced strong appreciation causing the pair to dive.

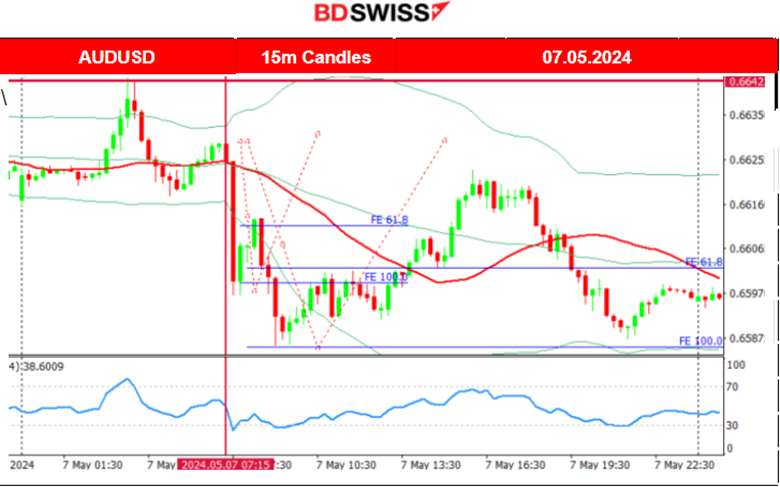

AUDUSD (07.05.2024) 15m Chart Summary

AUDUSD (07.05.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The market was quite volatile during the Asian session. The pair experienced a dip after the release of the RBA rate decision. Overall, the pair reached the intraday lowest after the news at near 0.65870 before reversing to the upside. It crossed the 30-period MA twice as volatility levels were quite high. However, the path remained sideways.

___________________________________________________________________

___________________________________________________________________

CRYPTO MARKETS MONITOR

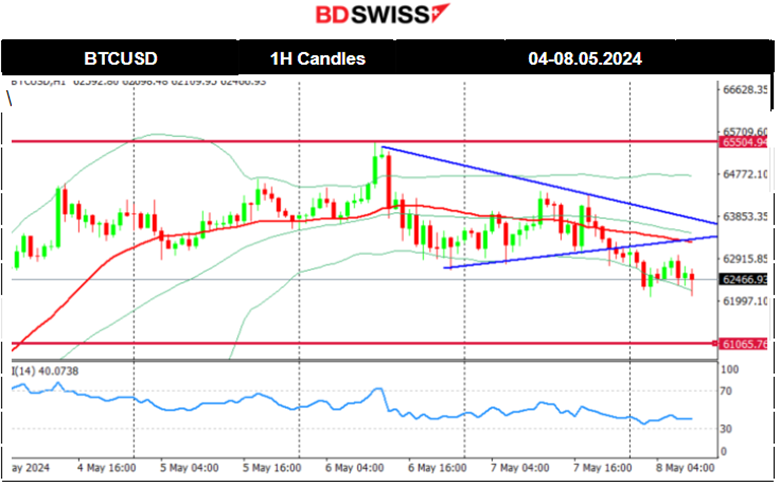

BTCUSD (Bitcoin) Chart Summary 1H

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Bitcoin remained below 65.5K USD these past days and does not show any significant signs of moving to the upside at all.

A triangle formation was breached on the 7th of May and this caused its price to drop to near 62K. This downside movement was a retracement to the 61.8% of the rapid large movement that started on the 2nd of May and from the support at near 56.5K USD.

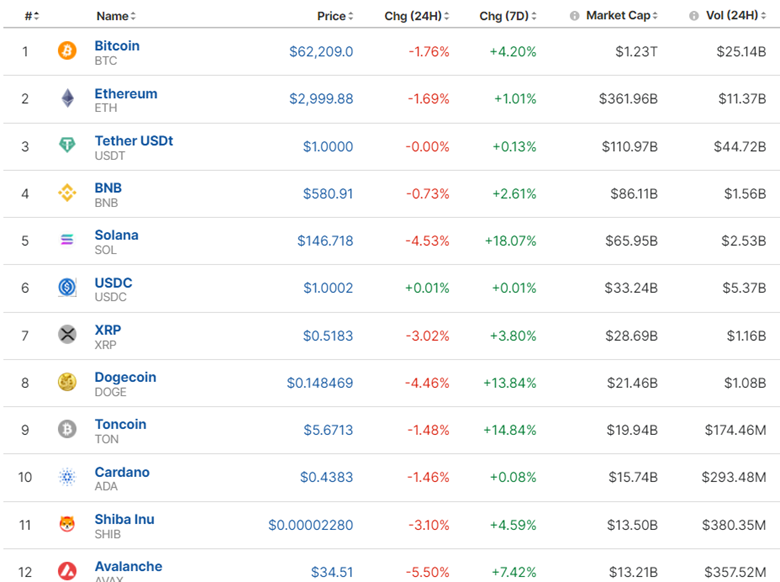

Crypto sorted by Highest Market Cap:

Crypto sorted by Highest Market Cap:

The crypto market does not see improvement. Bitcoin reversed to the upside after a large drop to 56,5K but remained low and currently is showing signs of moving again to the downside. For the last 24 hours, all Cryptos show underperformance.

Source: https://www.investing.com/crypto/currencies

______________________________________________________________________

EQUITY MARKETS MONITOR

S&P500 (SPX500) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 1st of May, the index jumped with the FOMC news but a full reversal took place soon after. After testing the intraday highs, the index started to move upwards remaining above the 30-period MA and kept breaking resistance levels. A clear uptrend. On the 7th of May, the RSI indicates a slowdown and bearish divergence.

______________________________________________________________________

______________________________________________________________________

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 1st of May, the price continued with the downtrend but after breaking the support at 80 USD/b the price dropped heavily to the next support at near 78.7 USD/b before retracement took place. It seems that Crude oil was following a downward channel while moving around the 30-period MA. That channel broke today with the next support probably at 76.50 USD/b.

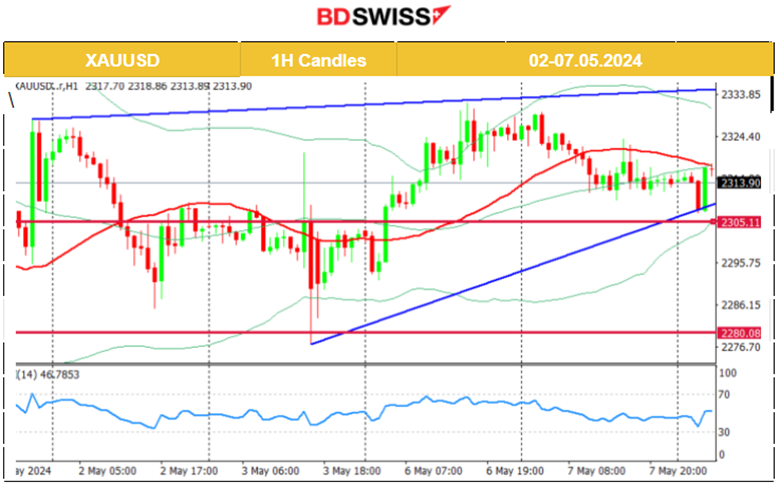

XAUUSD (Gold) 4-Day Chart Summary

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

On the 1st of May, the price moved to the upside as the dollar was depreciating and after the FOMC news, Gold jumped. After finding resistance it retraced but later moved to the upside again to test the resistance at near 2,327 USD/oz without success. It reversed fully to the downside. 2,305 USD/oz proved to be quite significant for Gold. The price on the 6th of May jumped until the resistance at near 2,330 USD/oz before eventually reversing to the MA and the 2,305 USD level. Currently, it is possible to see a movement to the upside if the dollar weakens, correcting from yesterday’s surge.

______________________________________________________________

______________________________________________________________

News Reports Monitor – Today Trading Day (08 April 2024)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No important news announcements, no special scheduled releases.

- Morning – Day Session (European and N. American Session)

No important news announcements, no special scheduled releases.

General Verdict:

______________________________________________________________