Market Analysis Review

U.S. Close to a Deal, FOMC Probably Hike Pause, USD Strengthens Further, Crude and Metals Lower

PREVIOUS TRADING DAY EVENTS – 25 May 2023

Announcements:

Biden said they still disagreed over where the cuts should fall.

“I don’t believe the whole burden should fall back to the middle-class and working-class Americans,” he told reporters.

House Speaker McCarthy told reporters on Thursday evening the two sides have not reached a deal. “We knew this would not be easy,” he said.

“They have suggested in the past that they would not announce auctions that they did not believe they had the means to settle,” Gennadiy Goldberg, senior rates strategist at TD Securities in New York. “So I do think that’s a positive note.”

“I don’t think everybody’s going to be happy at the end of the day. That’s not how the system works,” McCarthy said.

Source:

This is a slight increase but lower than the expected figure. Nevertheless, the Labour market seems to be steady and not so resilient. The Minutes of the Fed’s May 2-3 policy meeting published on Wednesday showed that policymakers “generally agreed” that the need for further rate hikes “had become less certain.” The Fed Meeting minutes showed that while “participants noted that the Labour market remained very tight,” they “anticipated that employment growth would likely slow further, reflecting a moderation in aggregate demand coming partly from tighter credit conditions.”

According to the GDP figure released at 15:30 yesterday, the Gross Domestic Product figure increased by a 1.3% annualised rate in the first quarter.

The Gross Domestic Income (GDI) declined by a 3.3% rate in the fourth quarter, revised down from the previously reported 1.1% pace of contraction.

“This weakness in GDI suggests that real GDP growth in recent quarters may be revised lower,” said Jay Bryson, chief economist at Wells Fargo in Charlotte, North Carolina. “Although one side of the economic accounts may be contracting, the U.S. economy is probably not in a recession at present.”

“The true health of the economy likely lies somewhere in-between as neither measure is perfect,” said Ryan Sweet, chief economist at Oxford Economics in West Chester, Pennsylvania.

_____________________________________________________________________

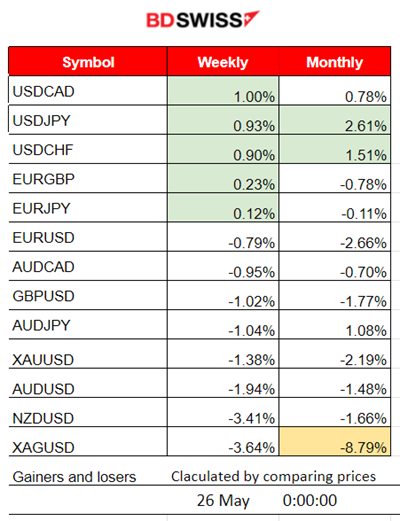

Summary Daily Moves – Winners vs Losers (25 May 2023)

- This week, USDCAD is leading with a 1% gain followed closely by pairs with USD as the base currency since the USD has been appreciating against other currencies for days.

- This month, USDJPY and USDCHF are on the top of the winners’ list with a 2.61% and 1.51% change respectively.

- Silver records 8.79% losses so far this month.

______________________________________________________________________

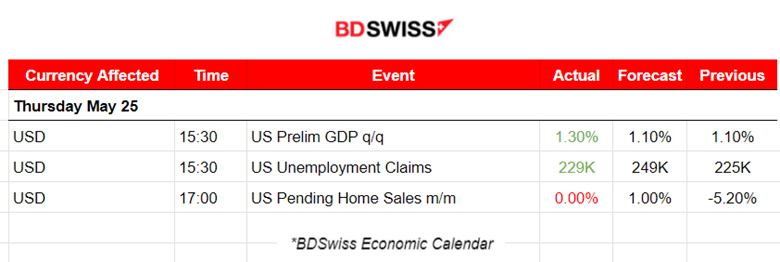

News Reports Monitor – Previous Trading Day (25 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

No significant news announcements. No scheduled important releases.

- Morning – Day Session (European)

At 15:30, the Preliminary figure for the U.S. Gross Domestic Product was released along with the U.S. Unemployment Claims report. The real GDP increased at an annual rate of 1.3% in the first quarter of 2023; a higher-than-expected figure. The advance figure for seasonally adjusted initial claims was 229K, an increase of 4K from the previous week’s revised level and a lower-than-expected figure. These figures caused the USD to appreciate at the time of the release, pushing pairs with USD as quote currency downwards, including metals. DXY jumped at that time.

The Pending Home Sales figure for the U.S. recorded no change in April, according to the National Association of REALTORS®. The USD was not greatly affected.

General Verdict:

______________________________________________________________________

FOREX MARKETS MONITOR

EURUSD (25.05.2023) Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

EURUSD started moving steadily downwards below the 30-period MA, following a downward intraday trend since the Asian session started. It experienced a more volatile path at the beginning of the European Session and it slowed down after finding some important support levels near 1.07150 before the news at 15:30. During the U.S.-related figure releases, the USD appreciated and so EURUSD was pushed down. The impact was not great. The pair continued to move sideways after the news. EURUSD path is mirroring the DXY path since the main driver is the USD.

____________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

The index started to drop significantly on the 23rd of May until the 24th, when it found support at 13530 USD. Surprisingly, after the FOMC Meeting minutes report that was released at 21:00, the index jumped. Its price reversed significantly as it crossed the 30-period MA and moved higher and higher. Yesterday, the index continued its upward movement, a path that does not coincide with the other U.S. indices, indicating that specific stocks are gaining while the stock market, in general, is on a sideways path.

______________________________________________________________________

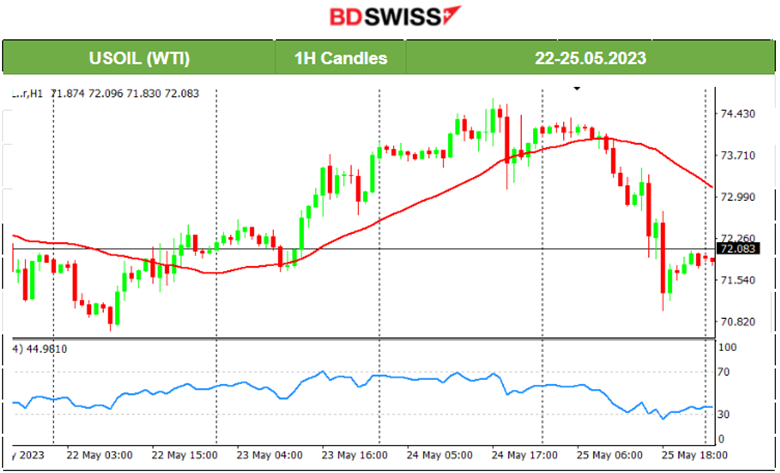

COMMODITIES MARKETS MONITOR

USOIL (WTI) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Crude was following an upward trend this week since the 22nd of May, moving while being above the 30-period MA. It experienced a price reversal as it dropped yesterday, crossing the MA and moving quite rapidly downwards, a nearly 3 USD drop. This surprise high deviation from the MA could be followed by a retracement when important resistance levels break near 72.1 USD/b.

XAUUSD (Gold) 4-Day Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movement

Gold was moving within a channel with a resistance level at 1985 USD/oz and support near the 1954-55 USD/oz level. Eventually yesterday, on the 25th of May, it experienced a drop when the U.S. Preliminary GDP and Unemployment Claims data were released. USD had appreciated greatly at that time. Gold experienced a nearly 21 USD drop at that time and found support at 1939 USD/oz. Retracement followed almost immediately and Gold settled on a less volatile sideways path later during the rest of the trading day.

______________________________________________________________

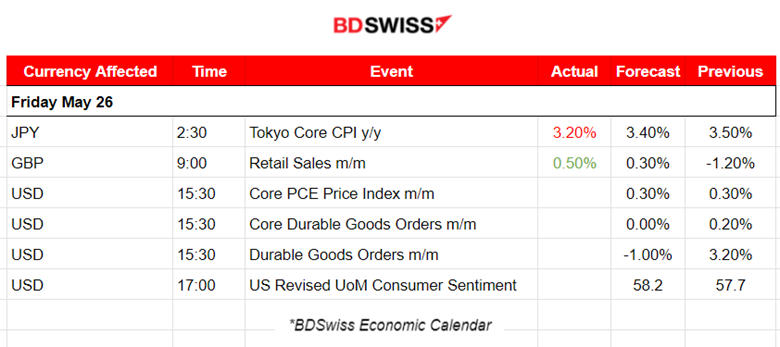

News Reports Monitor – Today Trading Day (26 May 2023)

Server Time / Timezone EEST (UTC+03:00)

- Midnight – Night Session (Asian)

At 2:30, the annual Tokyo Core CPI figure was released. It was low enough, at 3.20%, and lower than the expected 3.40% figure. Tokyo’s Core inflation is slowing from the previous month’s increase but remains well above the central bank’s 2% target. No major impact on the market with this release.

- Morning – Day Session (European)

The U.K. Retail Sales figures were released at 9:00. Retail sales volumes are estimated to have risen by 0.5% in April 2023, following a fall of 1.2% in March 2023. GBP has appreciated slightly due to the release against other currencies.

At 15:30, we have important figure releases again for the U.S., namely, the monthly Core PCE Price Index and Durable Goods data. The PCE differs from Core CPI in that it only measures goods and services targeted towards and consumed by individuals. It’s the Fed’s primary inflation measure, and that is why we expect an intraday shock for the USD pairs at that time.

General Verdict:

______________________________________________________________