Weekly Outlook

U.S. CPI & BOE Rate Hike Ahead, Rate Hikes: No Pause from ECB, U.S. Resilient Labour Market, Stocks Move Higher

PREVIOUS WEEK’S EVENTS (Week 01-05 May 2023)

Announcements:

U.S. Economy:

According to the U.S. ISM Manufacturing PMI figure, the manufacturing activity is still in contraction for the sixth month straight, according to the April data. The good news is that the figures suggest the manufacturing sector is shrinking at a slower rate. Eleven industries contracted while five industries expanded.

The U.S. JOLTS Job Openings figure release caused turmoil in the markets. Job openings were reported lower. The Job Openings data, showed a cooling demand for labour while layoffs increased to the highest level since 2020. U.S. job openings fell for a third month straight in March.

The U.S. ADP National Employment Report was released showing that private sector employment increased by 296,000 jobs in April. The market was expecting just a 148K increase, so this was quite a surprise. The Annual Pay was up 6.7%, the biggest private payrolls gain since July. This adds to the data suggesting a resilient labour market even as the economy cools.

The Non-Farm Employment Change and Unemployment Rate reports were released on the 5th of May. Total non-farm payroll employment rose by 253,000 in April, and the unemployment rate was reported at 3.4%. The data show that employment continued to trend up with hiring and workers’ pay accelerated in April. While fears of the recession were growing with high interest rates, inflation and tightening credit conditions, the data showed surprising signs of labour-market resilience once more.

Labour Data shows a strong and quite resilient Labour Market. Thus, since inflation is still way above target, the Central Bank raised its benchmark overnight interest rate by another 25 basis points to the 5.00%-5.25% range on Wednesday, before pausing hikes.

Eurozone and U.K. Economy:

The manufacturing sector in the Eurozone experienced a sharp deterioration in operating conditions, not by as much as expected though. Regional PMI indices in France and Italy showed a drop in output, while output in Germany and Spain showed nearly no activity.

The U.K. manufacturing sector continued with a decline in business activity at the start of the second quarter. British factory output and new orders contracted.

Yesterday, the PMI figures for the Services sector indicated that the business activity in the Eurozone experienced growth in April, although less than initially indicated. April was the survey’s fourth straight month above the 50 level. Italy and Spain are currently the main driving forces of the expansion according to economists’ statements. They also state that growth in the Eurozone services sector will continue.

New Zealand Economy:

New Zealand’s unemployment rate remained unchanged at 3.4% and not far from expectations, according to the latest release of Stats NZ.

The Reserve Bank of NZ (RBNZ) is raising interest rates to slow demand and estimates that there will be a recession this year. It is possible that the central bank is likely to hike interest rates later this month.

On May 24th, the RBNZ is expected to rate hike with a final 25 basis-point change, bringing the Official Cash Rate to 5.5%.

Switzerland Economy:

The CPI figure for Switzerland showed 0% monthly inflation in April 2023, lower than the previous 0.2% change and lower than expected. Swiss headline inflation remained above the central bank’s target range since February 2022. The SNB has hiked interest rates four consecutive times, bringing its benchmark to 1.5% in March. More hikes are expected.

Canada Economy:

Labour data for Canada, Employment and Unemployment change figures showed gains in jobs and unemployment to hold at 5%. According to the data, employment grew more than expected surpassing expectations for a coming economic slowdown and causing the CAD to appreciate.

It seems that rate hikes are failing to cool down the labour market. It has experienced its longest run of monthly job gains since 2017. It shows a high level of endurance in the face of high borrowing costs. If this persists, the Bank of Canada may be forced to start with hikes again.

https://www.reuters.com/article/swiss-inflation-idUSL8N37121P

https://www.reuters.com/markets/europe/euro-zone-factory-downturn-deepened-april-pmi-2023-05-02/

____________________________________________________________________________________________

Interest Rates

RBA:

The Reserve Bank of Australia (RBA) surprised the markets on the 2nd of May by increasing the cash rate target by 25 basis points to 3.85%. It was an unexpected move from the RBA which also stated that further tightening might be necessary. Inflation in Australia is at 7%, which is considered too high by policymakers. This unexpected rise caused the AUD to appreciate highly.

FOMC / Fed:

The FOMC Monetary Policy Report was released yesterday at 21:00 GMT+3, along with the Fed Rate, which was raised as expected to 5.25%. The Federal Reserve hinted it might be the final hike, pausing this aggressive tightening campaign.

They seek to achieve maximum employment and the long-run inflation target at the rate of 2%. It is doubtful that they are going to pause hikes for too long with such a high inflation figure.

“That’s a meaningful change that we’re no longer saying that we anticipate further increases” as Chair Jerome Powell said at a press conference following the decision.

ECB:

ECBs Main Refinancing rate was reported at 3.75% as expected. The European Central Bank signalled that since inflation is way above target, more tightening is to come. Headline inflation has declined over recent months, but underlying price pressures remain strong.

“We are not pausing – that is very clear,” ECB President Christine Lagarde told a press conference. “We know that we have more ground to cover.”

The consensus expects the ECB to hike rates by 25 bps in June.

_____________________________________________________________________________________________

Currency Markets Impact – Past Releases (01-05 May 2023)

_____________________________________________________________________________________________

Summary Total Moves – Winners vs Losers (Week 01-05 May 2023)

NZDUSD and AUDUSD reached the top of the winners’ list for the first week of the month with 2.16% and 2.02% gains respectively.

_____________________________________________________________________________________________

FOREX MARKETS MONITOR

EURUSD

Since the 2nd of May, the pair was moving upwards, from US dollar depreciation, until the 4th of May, when important figure releases, such as the ECB rate. This caused the pair to experience an intraday shock downwards and retrace back to the 30-period MA. Due to strong U.S. Labour data released the next day, May 5th, the pair experienced another shock downwards followed by another retracement.

USDCAD

The pair experienced a strong reverse in price starting from the 4th of May when it crossed the 30-period MA and moved downwards, experiencing a downward trend which continued until the end of the trading day, May 5th. Even though the CAD was gaining significantly against the USD before the 5th, strong Canada’s Labour Data pushed the CAD to dive even more. No retracement has taken place yet possibly because the downward rapid movement might continue further unless there are strong signs of support and short-term intraday resistance levels broken. A 4H chart is more suitable to see clearly the sharp drop. If the pair moves further down, the next support is probably near 1.33100.

AUDUSD

The pair jumped with the surprise rate hike on the 2nd of May by RBA. It was moving sideways around the 30-period MA during the middle of the week but eventually moved higher while the USD was experiencing depreciation and kept its upward move above the MA.

DXY (US Dollar Index)

The US Dollar moved lower the previous week. High depreciation took place in the middle of the week because of Labour data showing that the expected cooling of the U.S. labour market is finally happening. However, further Labour data, the NFP and the Unemployment rate showed that the Labour market is still strong and resilient to rate hikes causing the US dollar to find support or even appreciate against other currencies.

_____________________________________________________________________________________________

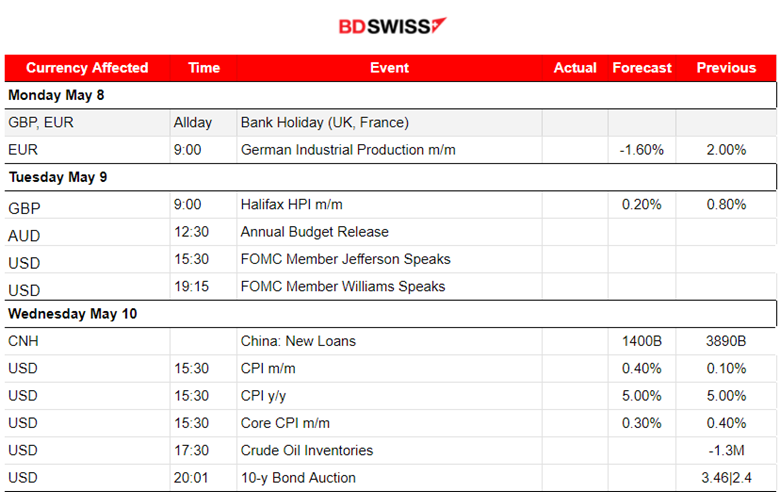

NEXT WEEK’S EVENTS (08-12 May 2023)

This week, U.S. inflation-related data are going to be released. We will eventually see if the Fed hikes are reaching their target. Monthly Inflation has been declining significantly but expectations show an increase of 0.30% from the previous month.

On the 11th of May, BOE is announcing its monetary policy and the official bank rate. A hike of 25 basis points is expected, from 4.25% to 4.5%. Considering the high level of inflation in the U.K. we might experience a surprise on this one.

PPI data and Unemployment claims released on the same day for the U.S. will surely have an impact on volatility.

The monthly change of the main economic indicator for the U.K. output, the GDP, is going to be released on the 12th of May. No change is expected.

Currency Markets Impact:

_____________________________________________________________________________________________

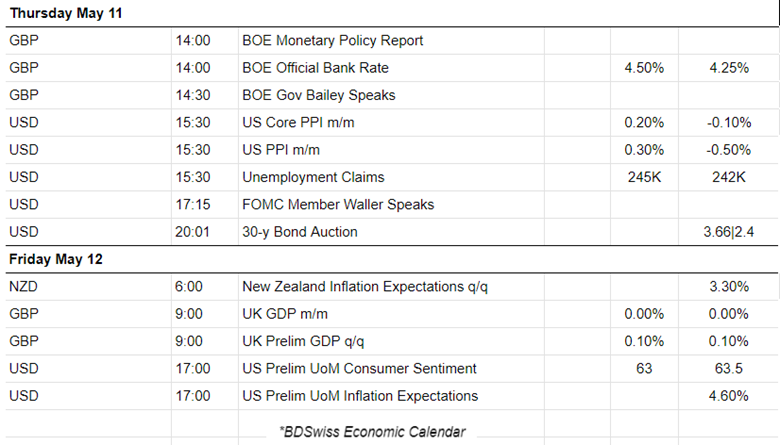

BOE Official Bank Rate

Even though the BOE has been increasing rates frequently since December 16, 2021, when the OBR was announced at 0.25%, which increased after a pause in changes from 0.10%, U.K.’s inflation rate remains too high. OBR is now at 4.25%. An increase to 4.5% is expected this week.

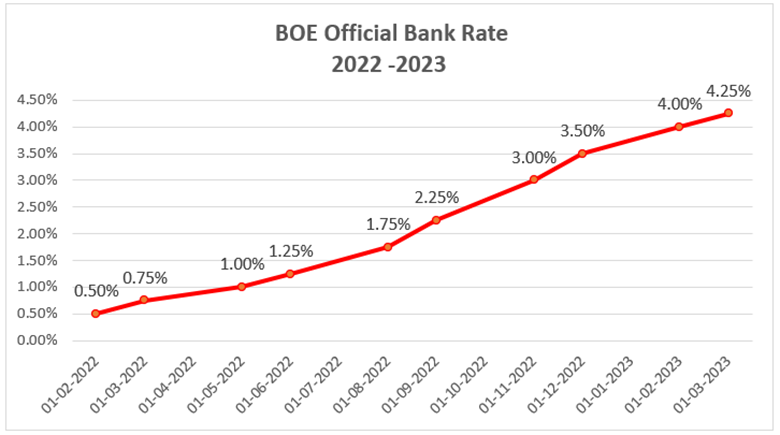

U.K. Inflation

It has remained above 10% since October 2022. Its peak of 11.1% was reported on November 16, 2022. The latest yearly CPI change reported figure was 10.1%.

_____________________________________________________________________________________________

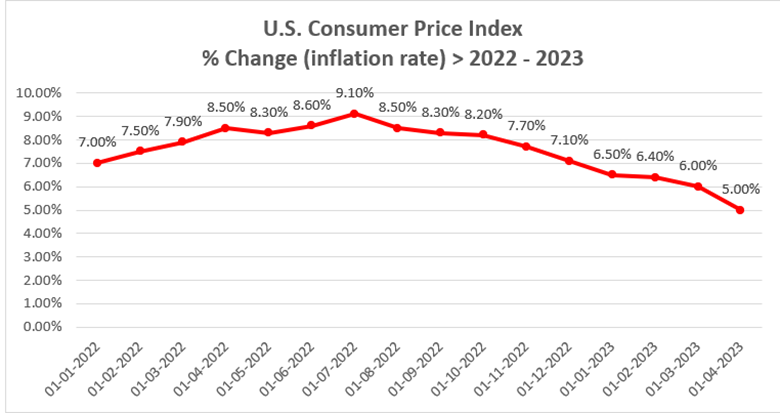

U.S. Consumer Price Index Change (Inflation)

The Fed has significantly reduced the inflation rate with its aggressive rate hike campaign. The target level is at 2% while Fed stated that hikes will pause for now. The CPI change was last reported at 5% and it is not expected to change as per consensus.

_____________________________________________________________________________________________

COMMODITIES MARKETS MONITOR

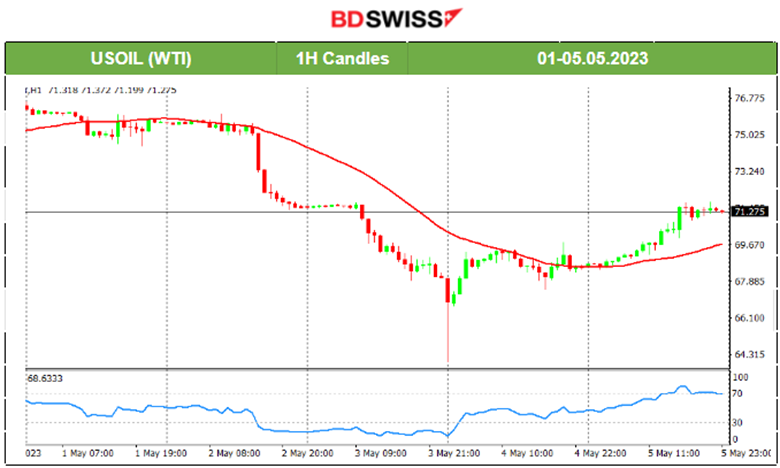

US Crude Oil

Crude Oil was moving downwards. The last report regarding Crude Inventory Data showed a decline of 1.3M barrels reported on the 3rd of May but it was a lower decline than the previous 1.5M. The USD depreciation and the pessimistic expectation of future business activity have affected demand. Since the 4th of May, it started to show signs of reversal. On the 5th of May, it was moving above the 30-period MA and the NFP data seemed to not have a major impact on its price.

Gold (XAUUSD)

Since the 2nd of May, Gold was moving higher because the USD fire releases were causing depreciation and also because investors’ preferences shifted to safer assets, such as metals. On the 5th of May, Gold moved lower and under the 30-period MA, ending the upward trend with the release of the NFP data. Labour data was strong causing the USD to appreciate heavily and Gold denominated in USD to lose ground. U.S. Stocks gained but Metals lost on this one.

_____________________________________________________________________________________________

EQUITY MARKETS MONITOR

NAS100 (NDX)

Price Movement

During the figure releases that took place on the 2nd and 3rd of May, we see that the index experienced a dive during both events. Fears of a U.S. recession were growing fast, affecting investors’ decisions and switching to a risk-off mood. Rate Hikes have been slowing down the Labour market, however, the Fed stated that a pause will follow. With NFP data released on the 5th of May, showing a high employment change figure, future expectations changed. The USD gained and U.S. Stocks were pushed upwards. This was in line with our expectations mentioned in the previous report, that there was a bullish divergence formed.

Price: Lower Lows, RSI: Higher Lows (Bullish Divergence). A Jump eventually resulted.

______________________________________________________________