Market Analysis Review

JPY up, CHF down; lots of Fedspeak

Rates as of 06:00 GMT

Market Recap

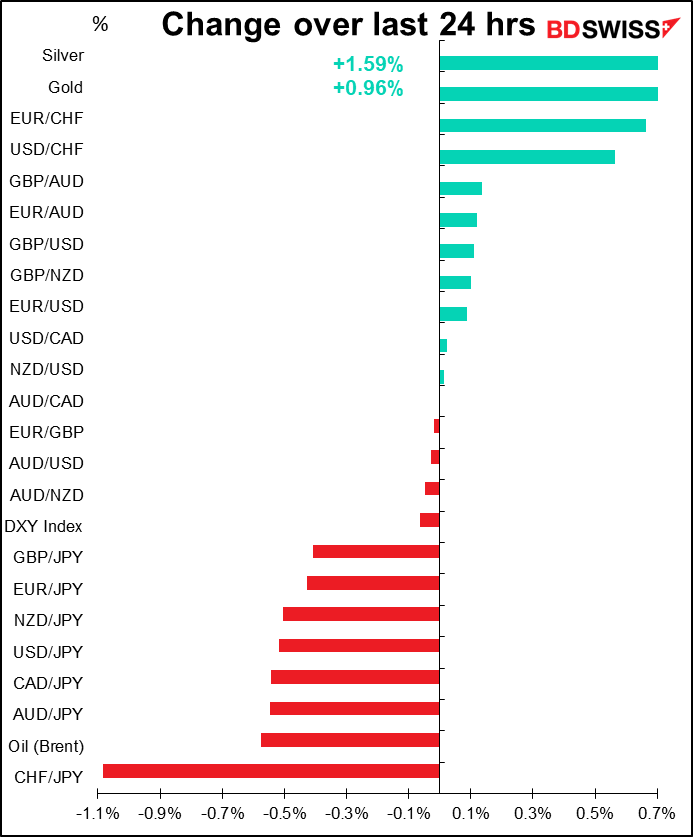

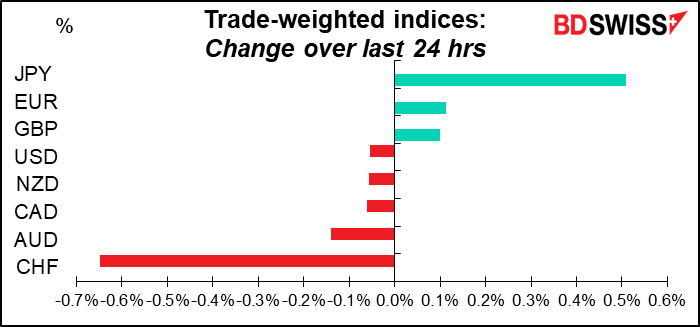

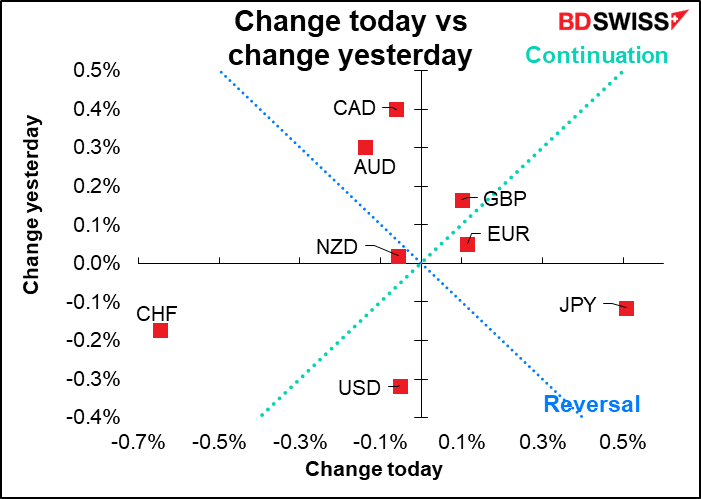

It’s odd to see JPY at the top of the table and CHF at the bottom. Often they are at the extremes when there’s a definite “risk-on” or “risk-off” mood in the market, but in that case they tend to move together. This time there really wasn’t that much change in risk appetite that I can see, at least not judging from the S&P 500, which closed down a small 0.14% (after being down as much as 2% during the day).

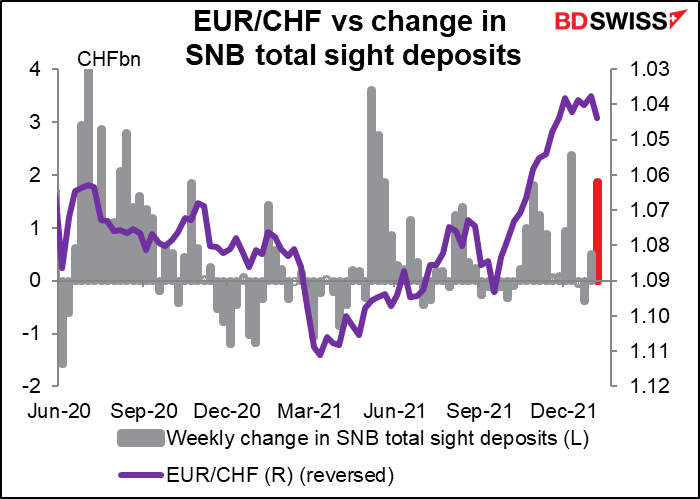

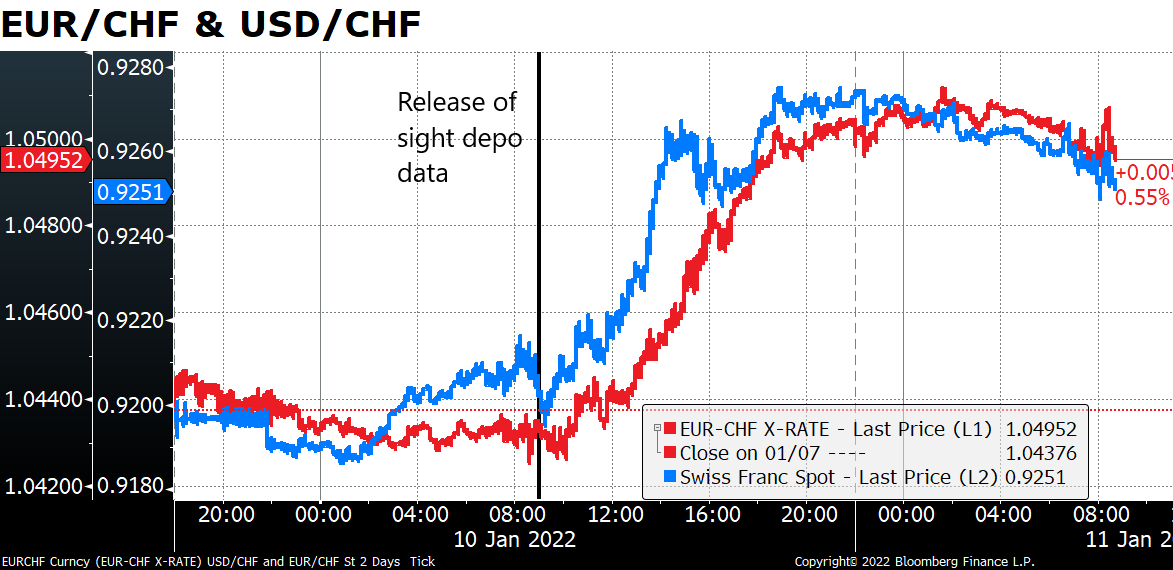

The only reason I can see for CHF’s poor performance specifically was the weekly Swiss sight deposit data, which showed that the Swiss National Bank (SNB) was intervening in size in the latest week. It now looks as if they are trying to hold the line at 1.04.

Although I have to admit that the sight deposit data is released at 0900 GMT and EUR/CHF didn’t start rising until around 10:30 GMT and didn’t take off until the US day began, so this explanation seems tinged with post hoc ergo propter hoc logic (the logical fallacy that because B followed A, A must have caused B. This is the basis of much reporting on the FX market.)

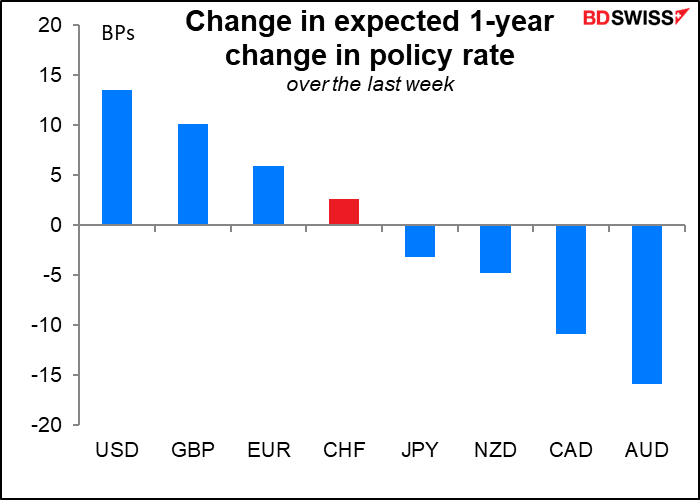

I thought it might be because of the market revising up the expected pace of tightening for various countries in the wake of what looks like the Fed’s rush to start normalizing policy, but AUD would be collapsing if that were correct, not CHF.

Perhaps it may also be due to the increase in expectations for European Central Bank (ECB) tightening. As the above graph shows, the market’s expectations for ECB tightening over the next year increased by 6 bps over the last week. That’s due in part to the higher-than-expected EU-wide consumer price index (CPI) announced Friday, which hit 5.0% yoy for the first time since the Eurozone was founded. Yesterday’s (small) decline in the Eurozone unemployment rate to 7.2% from 7.3% (as expected), if it continues, could help the ECB’s Governing Council to justify a rate hike later this year if they so choose even though they don’t have a formal “dual mandate.”

Also, ECB Executive Board Member Schnabel made a speech over the weekend in which she said that the ECB may need to stop “looking through” high inflation and act if high energy prices prove inflationary.

Schanebel’s speech mentioned a point that I’ve made briefly but is worth spelling out in more detail. Her argument is that “the green transition poses upside risks to medium-term inflation.” Carbon taxes mean higher energy prices, while the transition to renewable energy sources means that traditional fossil fuels are being starved of investment. However the increase in the output of renewables is not keeping pace with the increase in demand for energy plus the decrease in the output of traditional energy sources. Witness for example Germany’s decision to phase out nuclear energy by the end of this year, which will eliminate 12% of its electricity capacity. The country aims to make renewables meet 80% of power demand by 2030, but until then, coal and gas will have to make up the difference!

This conundrum reappears everywhere. Governments want to phase out coal and replace it with renewables, but renewable energy sources are not growing fast enough. The result will be more call on oil & gas even though banks are being urged not to lend to those companies for investment in greater capacity. The result may be an energy shortage and much much higher oil & gas prices until renewables can make up the difference. The slogan in the oil market is, “high prices cure high prices.” That is, it will take substantially higher prices for oil and gas to make it economically worthwhile to invest in sufficient renewable energy sources.

Today’s market

Note: The table above is updated before publication with the latest consensus forecasts. However, the text & charts are prepared ahead of time. Therefore there can be discrepancies between the forecasts given in the table above and in the text & charts.

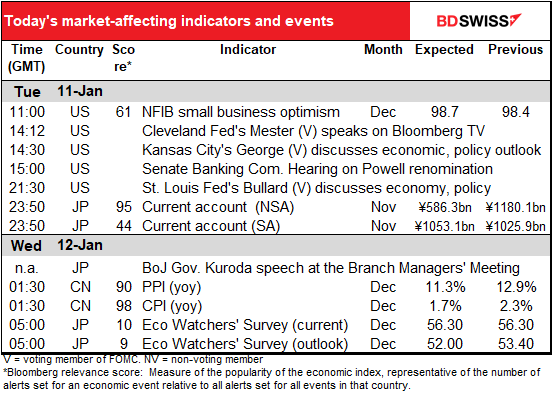

There are no major indicators out during the European and US days.

Instead, the focus will be on what the several voting members of the rate-setting US Federal Open Market Committee (FOMC) have to say. The focus will naturally be on Fed Chair Jerome Powell in the hearing on his reappointment in front of the Senate Banking Committee, plus there are three other voters speaking today as well. I doubt if Powell will face much opposition to his reappointment; he is after all a Republican appointed by a Republican president and reappointed by a Democratic president, plus at his initial hearing he was approved by a large bipartisan majority 84-13.

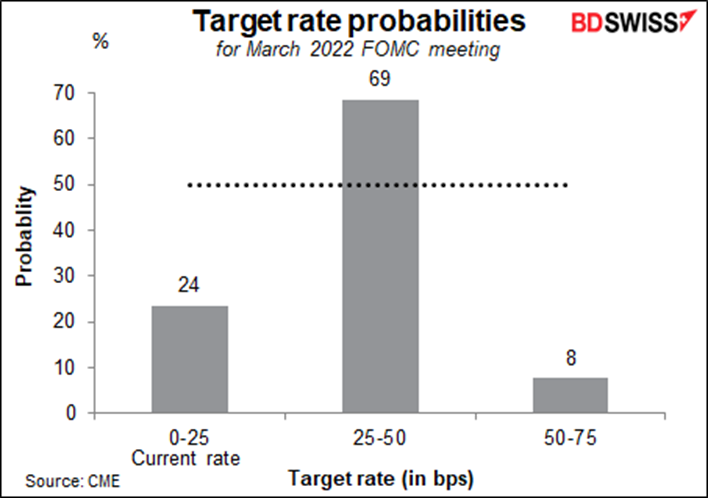

More to the point it will be interesting to hear his take and that of the other voters on the pressing issues facing the Fed, namely a) how soon after they finish tapering down their bond purchases are they likely to start hiking rates (answer: immediately, according to the market, which sees a 69% probability of a rate hike in March, which is also when they will end their bond purchases).

…and b) how long after they start hiking rates will they start reducing their balance sheet. San Francisco Fed President Daly last Friday said that “after one or two hikes, you could imagine adjusting the balance sheet.” She said that reducing accommodation that way might help the Fed to avoid a steeper path of rate hikes that could hamper the labor market.

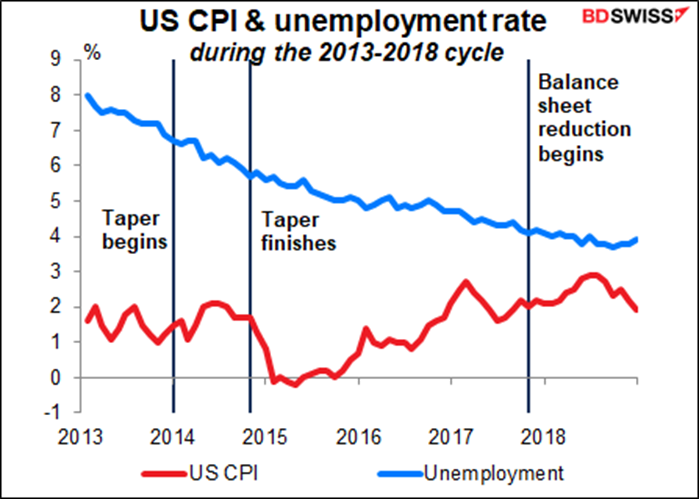

During the last rate cycle, the Fed waited until it had hiked four times (14 months) before starting to reduce its balance sheet, so two (4 months) would be a big change.

But during the last cycle, when they started reducing their balance sheet the unemployment rate was 4.1% and the CPI was 2.0% yoy. Today the unemployment rate is already lower than that (3.9%) and the CPI is much, much higher (6.8% yoy, maybe 7.0% yoy to be announced tomorrow). So a case could be made that they’ve already met the requirements for reducing their balance sheet.

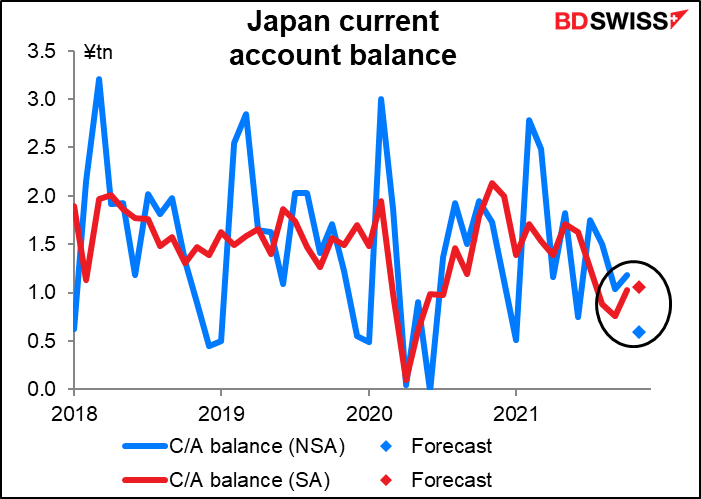

Overnight, Japan releases its current account data. The not-seasonally adjusted figure is expected to fall sharply, but that’s normal for this time of year – it would translate into a small rise in the seasonally adjusted figure. I don’t think a small move like this would have much impact on the FX market.

Of more importance perhaps is what Bank of Japan Gov. Kuroda says to his minions at the Branch Managers’ Meeting, plus what the Bank says in the quarterly Regional Economic Report. The focus is naturally going to be on prices, what with the corporate goods price index up 8% yoy and raw material prices up a stunning 75% yoy. Press reports suggest that the BoJ will raise its assessment of price trends and revise its inflation risk assessment in its quarterly Outlook for Economic Activity And Prices report this month, which will be published at the time of the Jan. 18th Monetary Policy Meeting. Questions include to what extent are companies passing along their higher input prices; how is the Bank is likely to react to the reemergence of inflation after its decades-long absence in Japan; and how high would inflation have to get for how long to get them to change policy.

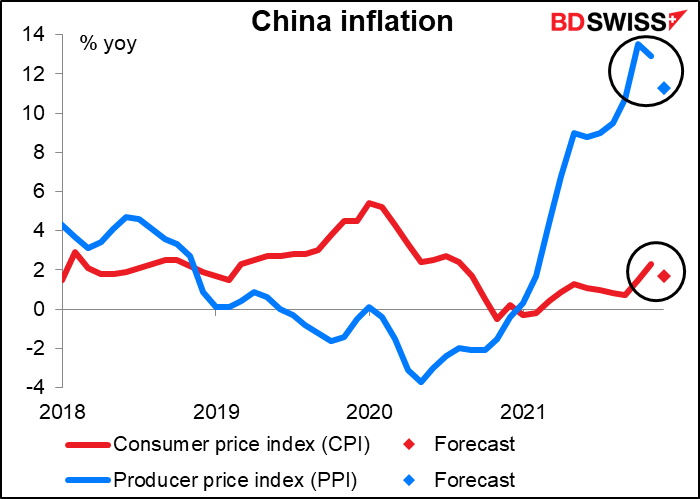

Speaking of inflation, China announces its producer- and consumer-price indices (PPIs & CPIs). The PPI is the more important globally because China’s producer output prices are a big part of everyone else’s import prices. The China CPI on the other hand tends to be determined by domestic food prices, which aren’t much concern internationally.

In this case, the big drop expected in the pace of increase of producer prices is welcome news. It supports the idea that perhaps the worst is over for inflation globally and that the pace of increase may slow from here.